To Revolve or Not to Revolve?

Authored by Joe Indvik, consultant in the Climate Change and Sustainability Division of ICF International in Washington, DC. Re-posted with permission from the AASHE Campus Sustainability Perspectives blog.

In the last few years, universities have emerged as a hotbed of investment in clean energy and efficiency (“cleantech”).

An increasingly popular and innovative tactic for making these investments is the green revolving loan fund (GRF). A GRF issues loans to finance cleantech and sustainability projects that can generate monetary savings. The returns from these projects flow back into the fund (“revolve”) and are re-invested in future projects. GRFs are often managed by a committee of community members who review loan applications and oversee fund operations.

The number of universities with a GRF has quadrupled since 2008, growing to at least 47 by the end of 2011. The Sustainable Endowments Institute (SEI) along with numerous partner organizations including AASHE, recently launched the Billion Dollar Green Challenge, an ambitious campaign that encourages and facilitates university investment in GRFs, with the ultimate goal of directing $1 billion of capital into these funds nation-wide. With an estimated $65 million already committed to GRFs as part of the Challenge, continued growth is expected.

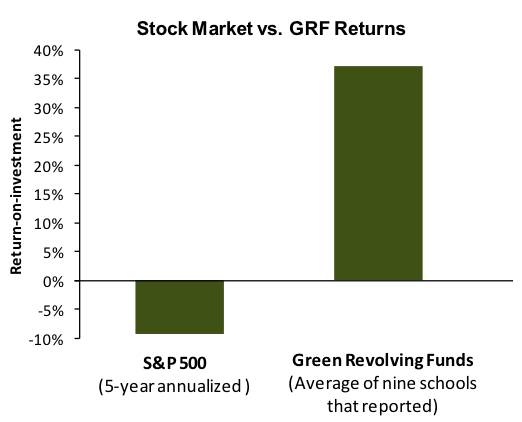

On the surface, this growth should not be surprising, as the case for making cleantech investments on campus is well established. Schools regularly report annual return-on-investment (ROI) in excess of 30% for cleantech projects (for additional statistics see the publication, Greening the Bottom Line). These projects usually pay for themselves in less than five years, and often much faster, while also reducing carbon emissions among other environmental benefits.

However, the choice to use a revolving loan mechanism to make these investments is not always so obvious. Any investment made by a GRF could also be made by spending directly out of the operating budget, capital improvement budget, or endowment. Energy savings would then be absorbed into the operating budget with no strings attached. So why use a GRF?

In my experience, there are several key factors that make GRFs the best choice for universities looking to make cleantech investments.

• The “sizzle” factor. A GRF is a unified, purposeful investment vehicle that is easy to market and generates a more positive public image than traditional investments. It demonstrates concrete commitment to sustainability in a way that one-time investments cannot.

• Turn expense into investment. Despite the massive cost-saving potential of cleantech investments, many colleges and universities are stuck in the rut of thinking about them as an expense only. By definition, the “revolving” mechanism brings savings into the limelight and explicitly directs them into future investments. When presenting this concept to administrators, I have shown the following graph. The first bar is annual ROI for the stock market (S&P 500). The second bar is annual ROI for university GRFs (reported to SEI).

• Leverage savings into opportunity. GRFs are a great way for schools to capitalize on the savings from cleantech projects to promote sustainability in general. For example, the Dartmouth Green Revolving Fund (full disclosure: I am a co-founder) directs 10% of the savings from renewable energy and energy efficiency projects into a Green Community Fund. Students, staff, and faculty can then apply for money from this fund for projects that promote sustainability on campus, whether or not they have financial paybacks.

• Bring the ivory tower down to the community. A GRF can engage the community by bringing diverse stakeholders to the table to make decisions about investments and chart a path toward sustainability. This happens via interactions on the management board and through the participatory process of writing proposals for funding. At a more basic level, GRFs are often started by students. Of the 47 funds surveyed by SEI, 17 were student-driven.

• Predictability and staying power. A GRF charter is usually written with specific requirements for projects to ensure fiscal discipline and environmental responsibility. Unlike investments made on a case-by-case basis, a GRF helps guarantee that money will be spent according to the criteria the founders intended.

• Check the box. Many rating systems, surveys and reporting programs look specifically for the existence of a GRF when reviewing organizations.

• Performance tracking. You can’t manage what you don’t measure. A GRF allows a school to draw a figurative box around a body of money, invest it in sustainability projects on a recurring basis, and then track the financial and environmental performance of those projects. This model lends itself to metrics like payback period, return-on-investment, carbon mitigation per dollar, and so on. For example, check out the “By the numbers” section of Harvard’s fund website. Clean, simple, and compelling. Try doing that with a suite of traditional capital allocations!

• Infinite scalability. GRFs can be effective with starting capital of $10 or $10 million. Whether the first investment is one lightbulb or a solar array, the model works. Many schools have started their funds off small to demonstrate effectiveness, then scaled them up once the administrative machinery is up and running.

I am convinced that Green Revolving Funds are the wave of the future for cleantech investment on campus. They have a notable financial, environmental, and educational upside and negligible downside in most cases. With initiatives like The Billion Dollar Green Challenge and student entrepreneurs leading the way, it will be exciting to see what the next few years have in store.

You can contact the author at Joe.Indvik@gmail.com.

-

Subscribe

Subscribe via RSS -

Archives

- August 2023

- December 2019

- October 2019

- December 2018

- August 2018

- December 2017

- December 2016

- October 2016

- August 2016

- May 2016

- November 2015

- October 2015

- September 2015

- May 2015

- April 2015

- February 2015

- October 2014

- August 2014

- April 2014

- March 2014

- December 2013

- November 2013

- September 2013

- August 2013

- April 2013

- March 2013

- January 2013

- October 2012

- July 2012

- May 2012

- January 2012

- October 2011